Entrepreneur's guide to US taxation

Tigran Harutyunyan

Kelsi and Platypus LLC

Intro

After marking the 10th anniversary of me filing my first tax return for a client, I regret to tell that I know almost nothing about taxes. Probably, I know a little more than an average person, but I am still learning every day. Therefore, I am extremely grateful to everyone who helps me learn. I am talking, of course, about people that ask me questions. There is nothing more rewarding for a professional than to get a challenging question and dig out the right answer. At some point, you realize what are the most commonly asked questions. That is what made me write this book. It is based on the most frequently asked questions by my clients. This book is not a replacement for an accountant or a lawyer. However, it provides enough information to a business owner to make an informed decision on few key questions, such as where to open a company; which legal structure to choose; what and how much are the taxes he or she will be paying. After you have read this book, you will have a general understanding of the whereabouts of an entrepreneurial life.

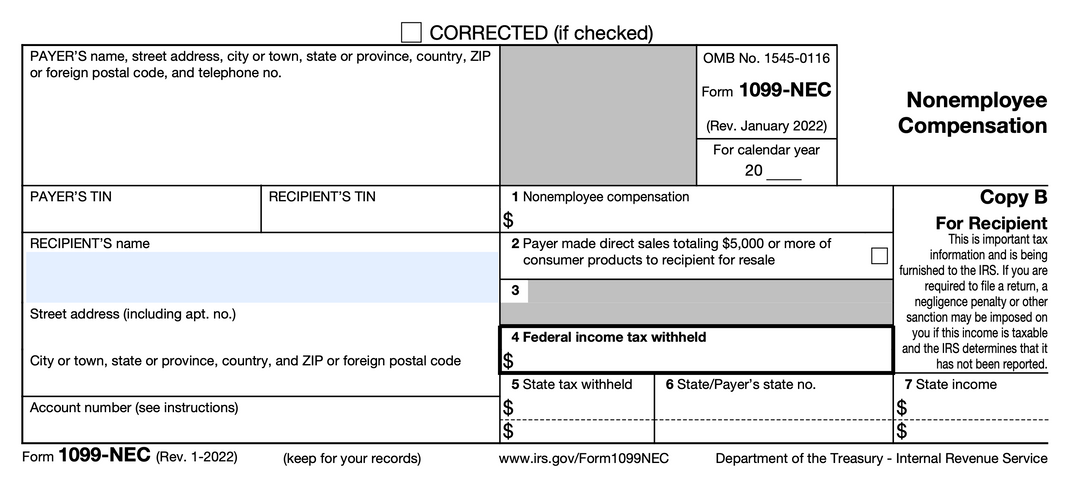

We will start with an introduction to tax returns and principals of taxation. Then we will dive into the steps required to start a company, examining the most common legal structures and how they are taxed. We will then go over how each state taxes businesses and what are the registration requirements in each of them. We will continue with what it takes to hire employees and contractors, have a glance at W and 1099 form series. In the last sections of the book we will also go over the sales tax, international entrepreneurs in the USA and will end the book with a tax calendar showing all required forms and their deadlines per entity.

Constructive criticism is always welcome. At the end of the book, you can find my email address, where you can send your comments and feedback.

- Introduction to Taxes

- Tax and Information Returns

- Extensions, Installment and Estimated Payments

- Penalties

- Most Common Taxes

- Tax Deductions

- Cash vs Accrual

- Profit and Loss

- Most Common Deductions

- Recordkeeping and Reimbursements

- Tax Credits

- Start a Company

- Determine Legal Structure

- Sole Proprietorship

- Definition

- Taxation

- General Partnership

- Definition

- Taxation

- C Corporation

- Definition

- Registration

- Taxation

- Officer Compensation

- Dividends, Salary, Stock Buyback

- Adding Capital

- S Corporation

- Definition

- Registration

- 2553 Election

- Taxation

- Limited Liability Company

- Definition

- Registration

- Taxaton

- Start a Company

- Determine the Jurisdiction

- Nexus

- Registered Agent

- Business Address

- Secretary of the State

- Department of Revenue

- Most Common State Taxes

- Choose The State

- California

- Wyoming

- Delaware

- Texas

- Washington

- Utah

- Wisconsin

- Pennsylvania

- Massachusetts

- Oregon

- Kentucky

- Florida

- Louisiana

- West Virginia

- Montana

- Rhode Island

- Arizona

- Virginia

- New Jersey

- New York

- Hawaii

- Illinois

- New Mexico

- Ohio

- Georgia

- Connecticut

- Choose The State

- Colorado

- Michigan

- Nevada

- Alaska

- Idaho

- Arkansas

- North Dakota

- South Dakota

- Nebraska

- Kansas

- Oklahoma

- Minnesota

- Iowa

- Missouri

- Tennessee

- Mississippi

- Vermont

- New Hampshire

- Maine

- Indiana

- South Carolina

- North Carolina

- Alabama

- Maryland

- DC

- Hire Employees

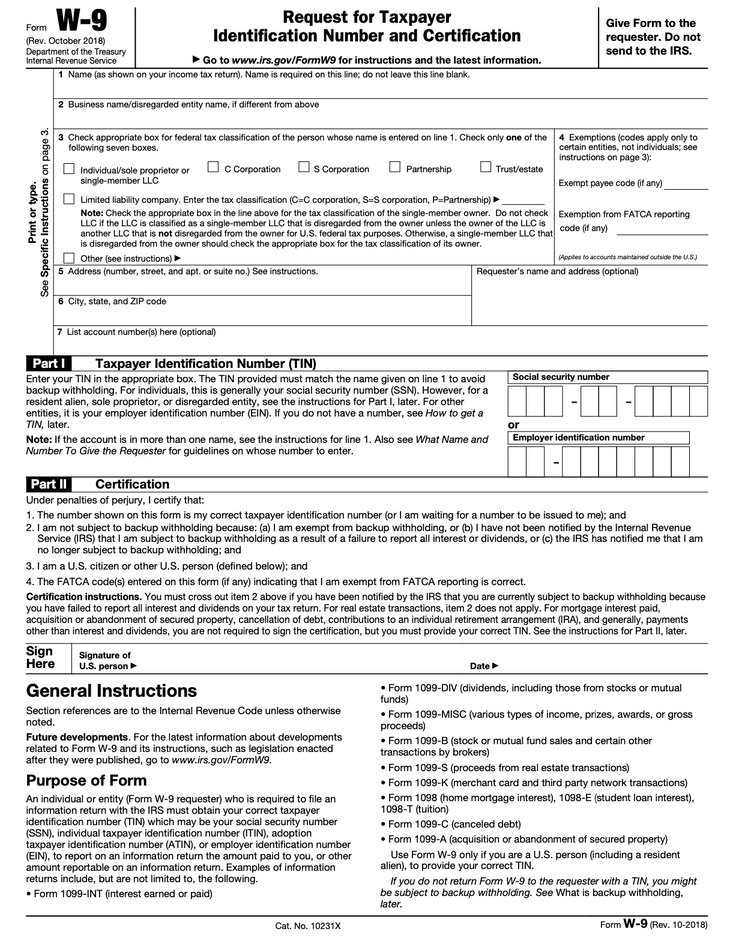

- Contractors

- Employees

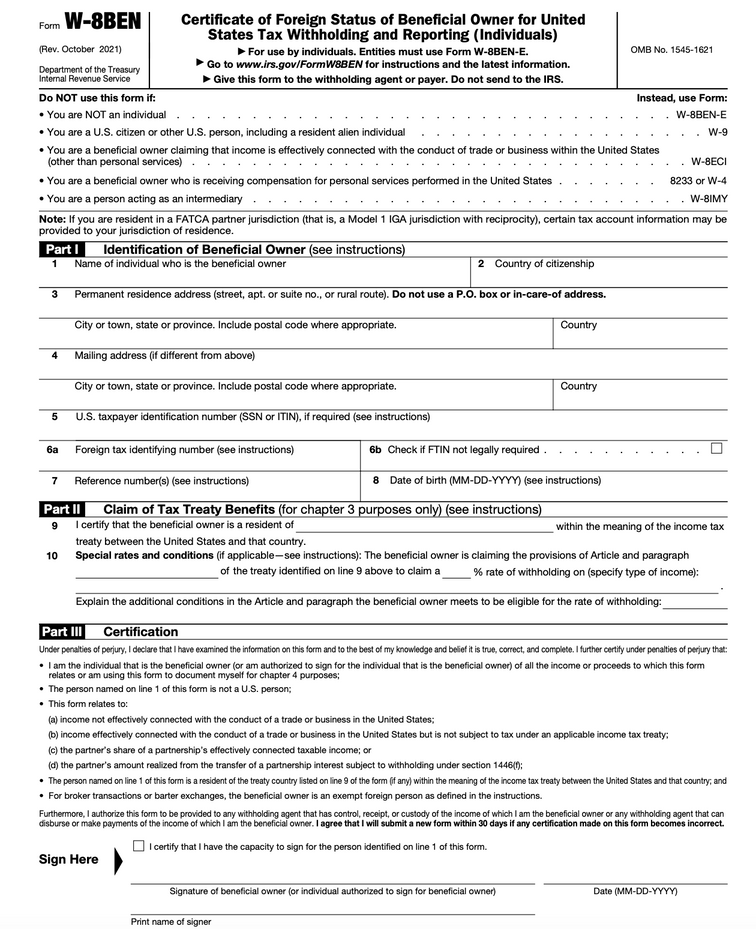

- International Contractors

- Payroll Taxes

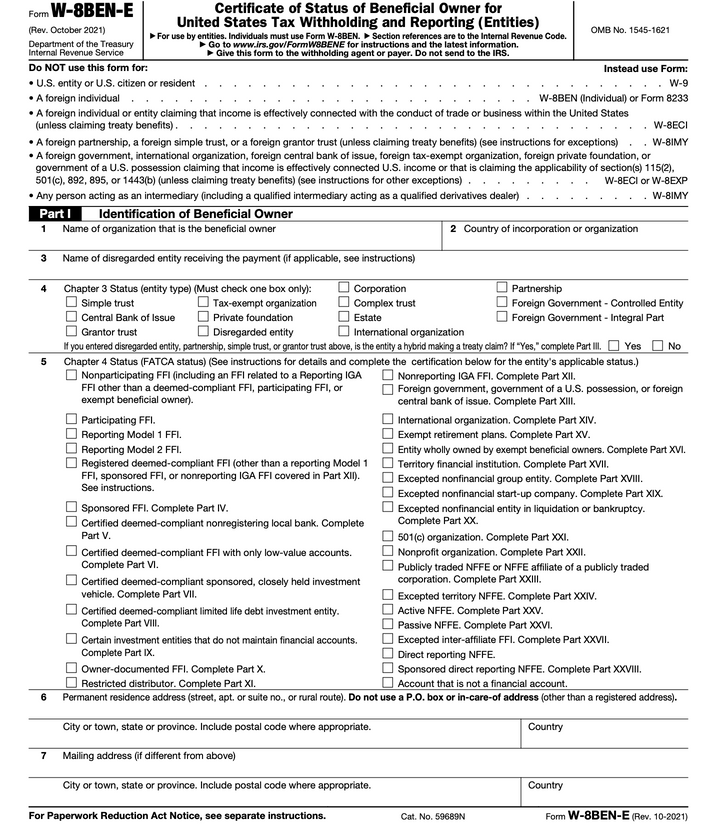

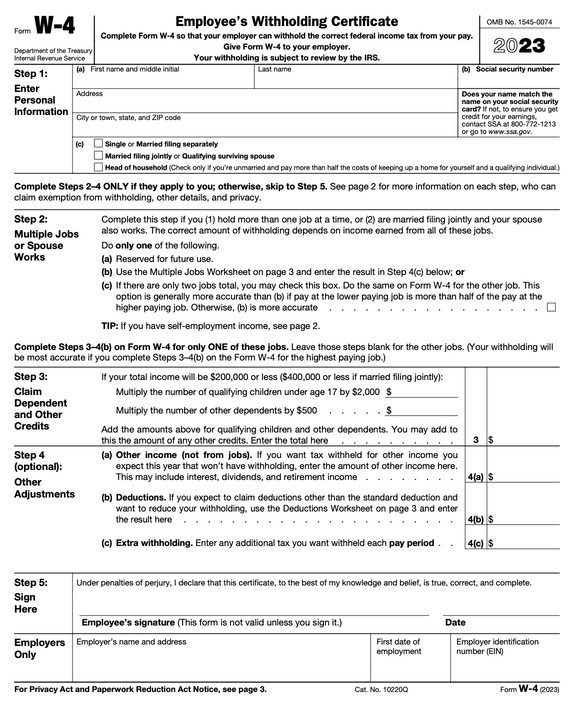

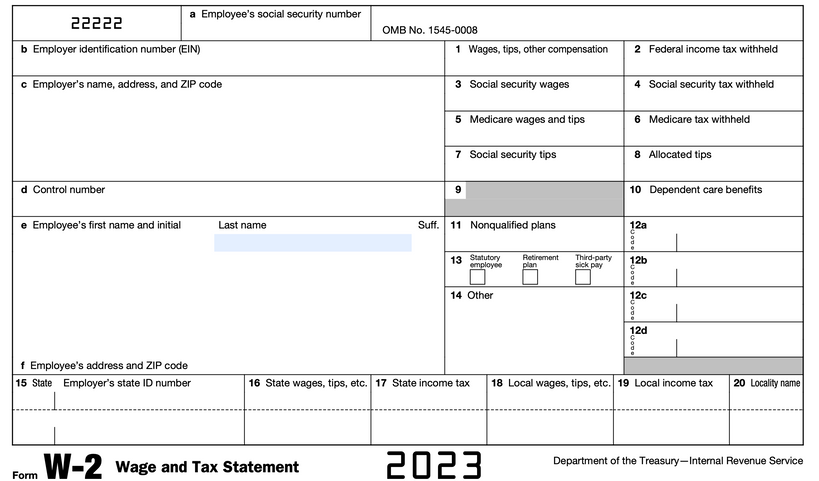

- W forms

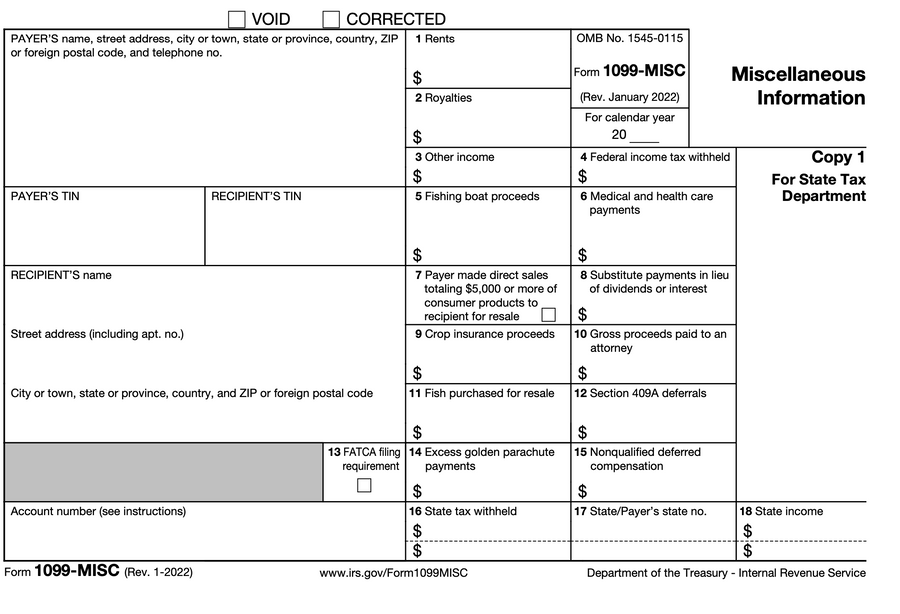

- 1099 forms

- Obtain EIN Number

- EIN for foreign entrepreneurs

- 83(b) Election

- Restricted Stock

- Example

- International Entrepreneurs

- Tax Residency

- US Sourced Income

- Foreign Owned LLC

- Foreign Owned Partnership

- Foreign Owned Corporation

- BE-12

- BE-13

- 5472

- Sales Tax Introduction

- Definition

- Economic Nexus

- Rate and Nexus Table by State

- Business Banking

- Checking Accounts

- Savings Accounts

- Credit Card

- Line of Credit

- Term Loan

- Auto Loan

- Equipment Loan

- Commercial Real Estate

- SBA 504, 7A, Express

- Merchant Services

- Tax Calendar

Introduction to tax returns

Tax

You probably heard this many times, but I'll repeat. The tax system in the United States is very complex. Both businesses and individuals may pay federal and state taxes. In oversimplified terms, a business first pays a federal and state tax on its net income. The remaining after-tax income is then distributed to the owners who pay personal state and federal income tax. It gets more complicated when it turns out that not every business has to pay an income tax, not every state has an income tax and income tax is not the only tax companies and their owners pay. Let's grasp this slowly. First, understand how taxes are reported and paid, then go over federal taxes by business type and end with the state taxes by business type and by state.

Information and Tax Returns

Financial activity of a business is reported on forms called tax returns and information returns.

Tax returns create a tax liability. For example, a c corporation reports their sales, expenses and net income on their corporate tax return and pays 21% net income tax while filing their return. Tax returns consist of the following components:

- Gross Income: Typically, the sales and other revenue

- Deductions: Expenses related to conduct of business

- Taxable Income: The difference between gross income and deductions

- Total Tax Liability: Taxable income x tax rate

- Tax credits: they directly reduce tax liability and are offered by IRS as incentives for certain behaviors such as R&D

- Tax already paid tax payments made during the year.

- Tax due: the difference between tax liability and credits and payments

Tax due (refunded) = (Gross Income - Deductions) x Tax Rate - Tax Credits - Tax Already Paid.

Information returns don't result in a tax liability but provide necessary information to IRS. They are filed by entities that do not pay income tax. For example, a general partnership files an information return to show how the net income was distributed to partners. Each partner will then show their portion of income on his or her individual tax return. IRS will use the received information to make sure the income reported on partners’ individual tax return matches to what was reported on partnership’s information return. In our legal structure section, we will cover federal filing and tax requirements by legal structure. Just like IRS, states may also require tax and information returns. In our states section we will cover the requirements of each state. Returns can be filed by mail or electronically. Electronic filing can be done through an e-file provider only. IRS does not provide such capacity on its website. You can check if your accountant is an e-file provider here: https://www.irs.gov/e-file-providers/authorized-irs-e-file-providers-for-individuals .

Personal

Information Return

Business

As shown in this scheme, business tax returns pay tax directly, while information returns pass information to IRS and the business owner, and the owner pays tax on it on his or her personal tax return. While c corporations file tax returns, s corporations and partnerships file information returns and sole proprietors report their business activity directly in their personal tax return.

Extensions, Installment and Estimated Payments

Most information returns are due on March 15 and most tax returns are due on April 15. Generally. it is possible to take a 6 month extension to file them. A 1 page form is submitted to IRS and an automatic approval is granted. No failure to file penalty will be imposed in that case. “Extension to file” is not an extension to pay. Any tax liability not paid by the original due date will accrue interest even if an extension was filed. If the company does not know its exact tax liability, it should make their best estimate and pay as much as possible. Any overpaid amount will be refunded when the tax return is filed. Any underpayment will be subject to interest. For example, on April 15 the company “Sliced Bread Inc”is not ready to file their tax return. Based on available records it has, it estimated a net income roughly equal to $1,000 and a $210 tax liability. It pays $210 when filing an extension. On October 15 the company finally has all the information to file its tax return. The actual numbers show $900 of net income and therefore $189 tax liability. IRS then refunds $21.

If the entity cannot afford to pay taxes in full, it should apply for an installment agreement. An installment agreement does not exempt from interest but protects from collections. So, if the corporation owes $1,000 in tax and wants to pay it in 10 months, monthly payments will be $100 + 0.05% monthly interest.

IRS and most states require quarterly estimated tax payments if the total liability for the year is $1,000 or more. Failure to make them will result in an underpayment penalty. While it is not always possible to exactly estimate the tax liability at the end of the year, IRS will not impose a penalty if the business paid estimated taxes equal to 100% of the previous year tax liability or 90% of the current year liability. Any overpayment will be refunded. For example, a corporation that in 2022 had $2,000 tax due. In 2023 year pays $500 a quarter in estimated payments. On April 15, 2024, when filing 2023 taxes, it turns out it owes $3,500 in tax. The company files tax return, pays the remaining $1,500 and since it paid 100% of the previous year taxes, even though their tax liability is $1,500, no penalties will be assessed.

Penalties

While we can write an entire book about different types of penalties, the 2 most common ones are failure to file and failure to pay and they are exactly what their names suggest.

Not filing a tax return on time will trigger failure to file penalty and not paying taxes on time will trigger failure to pay.

Let’s review the amounts based on entity types. We will review entities more in-detail later in the book.

Failure to File | Failure to Pay (Interest) | |

Sole proprietorship | 5% of the unpaid tax per month for every month the return is late for a maximum of 5 months | 0.5% of unpaid tax per month. No maximum. Applies after the failure to file maxed out |

General Partnership | $220 per month per partner for a maximum of 12 months | N/A |

S Corporation | $220 per shareholder per month for a maximum of 12 months | N/A |

C Corporation | 5% of the unpaid tax per month for every month the return is late for a maximum of 5 months | 0.5% of unpaid tax per month. No maximum. Applies after the failure to file maxed out |

Most Common Taxes

Business owners have a bevy of tax filing and paying obligations. Both the federal government and the states have the authority to collect taxes. They can be collected both from individuals and businesses. While most people think of a tax as a fraction of net income, there are way more types of taxes than the income tax. The following are the most common taxes imposed on businesses.

Federal Income Tax | Charged on net income by the federal government |

Capital Gain Tax | Imposed on income from sale of investment assets such as stocks or digital currencies |

State Income Tax | Charged on net income by the state |

State Revenue Tax | Charged on revenue by the state |

Franchise Tax | Annual license to do business in the sate |

Sales Tax | Collected from customers as a percentage of a sale |

Payroll Taxes | Paid as a percentage of wages paid to employees |

Quarterly Taxes | If previous year’s taxes exceed $1,000, company must make estimated quarterly tax payments. Any overpayment will be refunded after filing annual tax return. Any underpayment must be paid when filing annual tax return |

Tax Deductions

Profit and Loss

Every tax return has a profit and loss section where the tax-deductible expenses are deducted from the gross sales and the taxable income is calculated. Let’s review a C Corporation that in 2023 had $1mm in revenue, $700k in expenses as well as $400k loss in 2022. In the table below, first, we enter the revenue, then we subtract 100% of expenses for the year. The difference is the net income. We are allowed to carry forward losses from previous years up to an amount equal to 80% of the net income. So, from $400k loss we will deduct $240k = net income x 80%. The remaining $160k can be carried forward to 2024. The taxable income is $60k and the tax is 21% = $12,6k.

Gross Revenue (sales) | $1,000,000 |

Expenses | ($700,000) |

Net Income | $300,000 |

Loss carryforward from previous years | ($240,000) |

Taxable Income | $60,000 |

Tax Credits | $0 |

Tax | $12,600 |

Cash vs Accrual

Before looking at most common business expenses it is important to distinguish between 2 accounting methods: cash and accrual. Cash method recognizes income and expenses when funds have been received or paid. In contrary, Accrual recognizes the income and expenses when the payment is due by or owed to the company. In many cases this will be the same date. For example, a retail store is paid the day when the sale is made, or a makeup artist is paid once the service is provided. However, some businesses do not get paid or pay upfront. For instance, a company that supplies rubber to a tire producer supplied 100 units of rubber on December 12th, 2023. According to payment terms the tire producer pays once in a month. So, the payment for December invoice is made on January 1st, 2024. If using the cash method, proceeds from the sale of rubber will be registered on January 1st, 2024. If using the accrual method, the income will be reported in the 2023 tax return. The same logic applies to expenses. The choice of an accounting method is made on the tax return and while, conversions are possible, they should be done by a professional accountant.

Car and Truck Expenses

This is one of the most common and most generous deductions small businesses can take advantage of. It includes both cars and trucks Even if the car is only partially used for business purposes, the expenses can still be deducted to the extent that the car is used for business trips. Auto expenses are allowed even if the car is leased or financed and even if it is not owned or leased by the business. It is very common for business owners to use their car both for business and personal needs, so let's first define what a business purpose is.

Business purpose: while self-intuitive in most cases, it is important to clarify some common confusions. Commute to regular place of business is not considered a business use. Driving to meet clients, transporting goods and people for money are all examples of business use. It is the company’s responsibility to keep a log of miles driven for business. the number of miles driven for business divided by the total miles is the business use percentage. For example, in 2023 the company ABC drove a total of 1,000 miles from which 200 were personal miles of the owners. 200 / 1,000 x 100% = 80% is the use percentage. Multiplying it by total car expenses we can get the tax deductible part. So, if the total car expenses are $500 then $500 x 80% = $400 that is tax deductible. Now, let’s see how we calculate the expenses. There are 2 ways allowed by IRS:

- Standard Mileage

- Actual Expenses

Standard Milage

This is a generous and a simplified calculation method for small businesses that have less than 5 cars. The miles driven for business are multiplied by the standard mileage rate. For 2023 the rate is $0.655. So, if the company drove 1,000 miles for business, the tax deductible expenses will be 1,000 x $0.655 = $655. When using standard mileage, you can no longer deduct actual expenses such as car insurance, gas, maintenance and repairs, lease payments, depreciation or registration. You can still deduct parking and tolls as well as interest paid if the car is financed. If you start using standard mileage for a given car you should use it for the lifetime of the car. Standard mileage is limited to cars, vans, pickup trucks and some small trucks. Large commercial trucks cannot use standard mileage.

Car and Truck Expenses

Actual Expenses

Just like the word suggests, these are actual expenses spent on a business car or a truck. It includes the following:

- Gas

- Repair and Maintenance

- Car Insurance

- Lease Payments

- Registration and Title

- Depreciation

The total spent is then multiplied by the use percentage and the result is tax deductible.

Depreciation:

While most of the expenses are pretty straightforward, the depreciation requires additional attention. When buying as assets that has a lifetime of over 1 year such as a car, the full price cannot be deducted immediately. Instead, it needs to be depreciated over time. The most common way of doing it is with the straight-line depreciation. The total cost is divided by the useful life of an asset and the result can be deducted each year until the asset is fully depreciated. For cars the useful life is 5 years. For example, the cost of the car is $20,000. 20,000 divided by 5 = 4,000. $4,000 is the amount that can be deducted each year for the next 5 years. Contrary to straight-line, section 179 depreciation allows a larger depreciation for the first year when the car is placed in service as longs is it is used for business more than 50% of the time. Bonus depreciation is another special provision put into effect during Covid that allows businesses to deduct up to 100% of the asset during the first year of use. For 2023 the limit was reduced from 100% to 80%. So, a car bought at $20,000 can be written off up to $16,000 during the first year.

Actual expenses method also allows adding tolls, parking and interest. If for a given car, actual expenses method was used during the first year of service, it cannot be changed to standard mileage in the future.

If the car is not registered under the business, but is used for it, it is still possible to deduct expenses. If the business is an LLC or sole proprietorship or general partnership, the owners can deduct their car expenses just like if it was registered under the entity. Employees of those entities will need to submit reimbursement requests when their cars are used for business purposes. The reimbursement is tax deductible. For corporations, owners or employees must submit a reimbursement request when the car is used for business and the reimbursement is typically tax deductible.

Payroll Expenses

Any money paid to employees and contractors, as wells as tax paid for them and cost associated with processing payroll are tax deductible. It is important to distinguish between taxes withheld and paid on behalf of an employee and taxes paid for an employee. In most cases employers must withhold tax from employee's paycheck and remit the to the federal and local tax agencies. These expenses are deducted as part of the salary but not as tax paid. On the other hand, the employer is responsible for paying half of the Social Security and Medicare taxes. Those are deducted as “taxes paid”. For example, a company paid $1,000 to its employee. $200 were withheld from $1,000 gross pay as taxes and remitted to tax agencies. Also, the company was responsible for paying $75 in Social Security and Medicare taxes. In the tax return $1,000 will be deducted as salaries paid and $75 will be deducted as tax paid. The costs of processing payroll such as the payroll processor fees are deductible as accounting or payroll processing costs.

The payments made to contractors are also tax deductible, typically as outside contractor expenses.

Tax Expenses

This one may seem strange, but taxes paid to state and local governments are generally deductible on federal tax return. Unfortunately, it doesn’t work the other way around. Taxes paid to the federal government are not deductible on state tax returns. Some examples of state and local level taxes that can be deducted are state franchise tax, state income tax, sales tax etc...

Home Office Use

In some circumstances IRS will allow companies to deduct part of the cost to rent / buy and maintain home to the extent it is used for business purposes. As working from home has become more and more common, there are some confusions about this deduction. To qualify for home use for business, a part of the house must be used exclusively for business. A dentist, building a clinic in the garage will be a perfect example when the deduction is allowed. On the other hand, a CEO working from his bedroom where he or she also sleeps does not qualify for the deduction. If using a bedroom as an office, it cannot be used for anything else to qualify for the deduction.

There are 2 methods for figuring out the deduction amount:

- Simplified

- Regular

The simplified method simply computes the total square feet used for business and multiplies it by $5. There is a 300 sqf cap on this method. So, the maximum deduction a business can get is $1,500.

The regular method does not have an upper limit and allows for deduction of the following expenses:

- Mortgage interest

- Rent

- Depreciation (on residential properties the useful life is 27.5 years and commercial ones 39 years. So, a residential property worth 1mm will have an annual deduction of $36,363)

- Utilities

- Property tax

The total amount is then multiplied by the percentage of use for business. The percentage is derived by dividing the sqf used for business by total sqf in the property. For example, a residential property with 1,000sqf is worth $100,000. the room used solely for business is 200sqf. The utility is $10,000 annually and property taxes are $1,000. First, we find out the percentage of use. 200 / 1000 = 20%. Then find out total expenses: $100,000 / 27.5 + $10,000 + $1,000 = $14,636. The last step is to multiply the total expenses by the percentage use: $14,636 x 20% = $2,927.2 is the tax deductible amount.

Travel and Meals

Another deduction that often causes confusion is travel and meals. Generally speaking, food is not a tax deductible expense but under some circumstances IRS will allow for deduction. There are 2 type of meal deductions:

- 100% - when meals are provided to employees as part of the compensation (company must report it in employees’W2) or when meals are provided during companywide events such as holiday parties or milestone celebrations. More than 50% of the team must be present to claim a companywide party.

- 50% (certain federal transportation workers are eligible for 80% deduction) - when business owners or employees travel away from home at distances where it would be unreasonable to bring food from home, the meals are 50% deductible. Also meeting with clients are 50% deductible.

Luxurious meal and beverage expenses do not qualify for a deduction. IRS advises using https://www.gsa.gov/ guidelines for daily meal allowances per region. All other meal expenses, such as lunches not included in employee compensation, do not qualify for tax deductions.

Travel expenses are typically deductible if the travel is for business. Everyday commute to a place of business does not qualify as a tax deduction. Typical travel expenses are airline tickets, car rentals, taxi and hotels used for conferences, client meetings etc... If the travel is both for business and leisure, 50% of expenses can be deducted.

Other Expenses

- Financial: When borrowing money, the interest paid is tax deductible in the year it was paid or accrued.

- Advertising: money paid for conventional advertising as well as different ways of promoting the business can be deducted from the revenue

- Legal and Professional: payments to lawyers, consultants and other professionals providing services.

- Accounting: payments to third-party accountants and accounting softwires. Do not include accountants that are employed, instead deduct under payroll or contractors.

- Dues and Subscriptions: different membership fees can be deducted.

- Insurance: Business insurances such as general liability or worker’s compensation can be deducted.

- Benefits paid to employees: includes retirement plan contributions, perks and health insurance.

- Anything else that is directly related to the conduct of business.

Recordkeeping

IRS requires that businesses keep accurate records of their expenses. While they do not need to be attached to tax returns, the IRS may request them up to 7 years after filing the return. If the company is unable to provide a substantial proof an expense it may be disallowed, creating additional tax liability and possible penalties. To satisfy the recordkeeping requirements, every expense must have:

- Date the expense happened.

- Date payment was made.

- Name of the person / company the payment was made to.

- The amount.

- A short description.

For everyday expenses such as gas or supplies store receipts are sufficient. For payroll expenses, payroll journal records must be kept. Professional fees paid to lawyers, accountants or other businesses can be substantiated by invoices as long as invoices have the information mentioned above. Below is an example of an invoice that satisfies IRS recordkeeping requirements.

Invoice #1005 date: 09/01/2023 | Description | Unit price | Total Price | |

Billed to: Quacky Quack’s LLC 121 zzyzx rd Belleville, CA 12345 | 10 units of rubber ducks | $10 | $100 | |

For Period 08/01/2023-08/31/2023 | Tax | 9.25% | ||

Total Price | $109.25 | |||

Reimbursements

Sometimes, business officers and employees use their personal assets for the benefit of the business. Some examples include an employee driving his or her personal car to meet clients, or an office manager buying office supplies with his or her personal credit card. While it is perfectly legal to do so, the company must properly reimburse officers and employees to be able to deduct it as an expense. For that, a reimbursement request must be submitted. While there is no required template, the request must contain the name of the officer / employee; date of the transaction(s); description of the transaction(s); amount paid. It is later submitted to the company for approval and payment. The proof of payment alongside with the reimbursement request satisfy recordkeeping requirements of the IRS. See example below for a sample reimbursement request.

09/01/2023 | Description | Amount |

08/17/2023 | Bought coffee for office | $25 |

08/21/2023 | Drove 10 miles to a client meeting | $6.55 |

Total | $31.55 | |

Submitted by | Kelsi Mac | signature |

Approved by | John Doe | signature |

Tax Credits

Tax credits directly reduce tax liability. For example, a company owes $10,000 in tax but has $2,000 in tax credits. The total tax liability will be $8,000. Tax credits are offered to support certain industries and encourage certain behaviors. For example, Research and Development credit reduces tax liability for companies that conduct research activity in the United States. Employee retention credit was a special tax credit offered to employers that did not lay off their workforce. There are 2 types of tax credits:

- refundable

- non-refundable

If a refundable credit amount exceeds the tax liability, the difference is refunded to the business. Non-refundable credits are limited to the extent of the tax liability. For example, a business owns $10,000 in tax and has $13,000 in refundable tax credits. $3,000 will be refunded to the business. If the entity has both refundable and non-refundable credits, non-refundables will apply first unless otherwise instructed by IRS. For instance, C corporation Qucky Quack Corp owes $10,000 in tax and has $4,000 in non-refundable credits and $8,000 in refundable credits. The corporation will first apply $4,000, reducing its tax liability to $6,000 and then the refundable $8,000, becoming eligible for a $2,000 tax refund.

This concludes our introduction to tax returns. In the next sections we will cover everything necessary to start a company.

Start a Company

Open a bank account

Obtain EIN

Determine the legal structure

Determine the jurisdiction

Register with the jurisdiction

Start A Company

There are typically 5 important steps for opening a company. In the next section we are going to cover in detail all 5 of them. Let’s take a quick peek now.

- Determine the legal structure: we will go over the 5 most common legal structures.

- Determine the jurisdiction: we will go over tax types and rates and registration process in all 50 states and DC

- Register with the jurisdiction: there is no federal registration for a company. Legal entities are registered in states

- Obtain EIN number: this is a unique federal tax id that allows paying federal taxes

- Open a bank account: we will go over most important banking products business owners need.

Sole Proprietorship

Determine the legal structure

General Partnership

C Corporation

Limited Liability Company

S Corporation

Sole Proprietorship

A sole proprietorship is a type of a business organization in which an individual operates and manages the business as the sole owner. It is the simplest and most common form of business ownership. You do not have to register your business with the state and as long as you haven't hired employees you don't have to obtain an EIN number.

There are 2 ways to name a sole proprietorship:

- Using owner's last name in the business name

- Obtain a fictitious name from the county clerk's office

For example: "Doe's Bakery" owned by Jane Doe will not require obtaining a fictitious name. However, "Sausalito Bakery" with the same owner will require a fictitious name. Fictitious name is filed with the county clerk and simply notifies public that the owner will be conducting business under a different name. In this case the official business name will be "Jane Doe Doing Business as Sausalito Bakery". Typically, the filing is very simple, only takes few minutes and costs less than $100. Look up your country clerks address or website and ask / search for a fictitious name registration.

Taxation

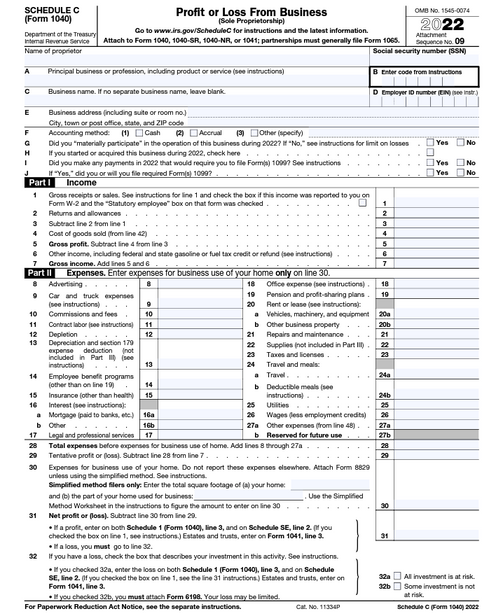

There is no separate federal income tax on sole proprietorships. The revenue and expenses are reported on the form Schedule C that's attached to personal tax return and the net income is combined with owner’s personal income and he or she pays personal income tax on it. Also, the owner is subject to roughly 14.22% self-employment tax on net income with certain limits. In most states there is no state franchise, business income or revenue tax imposed on sole proprietorships.

For Example:

Doe's Bakery had $250,000 in revenue, $150,000 in expenses and $100,000 in net income. $100,000 net income will be subject to $14,130 self-employment tax and $9,752 personal income tax plus state income tax if applicable.

Because of this, there is no special procedure for the owner to pay him/herself or to invest money in the business. Owners can make non tax deductible withdrawals and nontaxable deposits.

Sole Proprietorship | |

Registration | Not Required |

Name | Tied to owner's name, not unique |

Liability | Unlimited |

Business Tax | None |

Taxes | Schedule C, attached to personal tax return April 15th. |

General Partnership

Partnership is similar to a sole proprietorship by its structure but has more than 1 owner. There is no need to register with the state. However, a partnership agreement is required. An EIN number is required for a partnership. The name must either contain the last names of partners or the partnership should obtain a fictitious name from the county clerk. There is unlimited responsibility for the general partnership meaning, the collectors can go after the personal assets of the partners.

You do not have to register the partnership with the state, even though some states will give you that option. A partnership agreement must be signed between partners outlining how the partnership is managed and how the net income is distributed.

Taxation

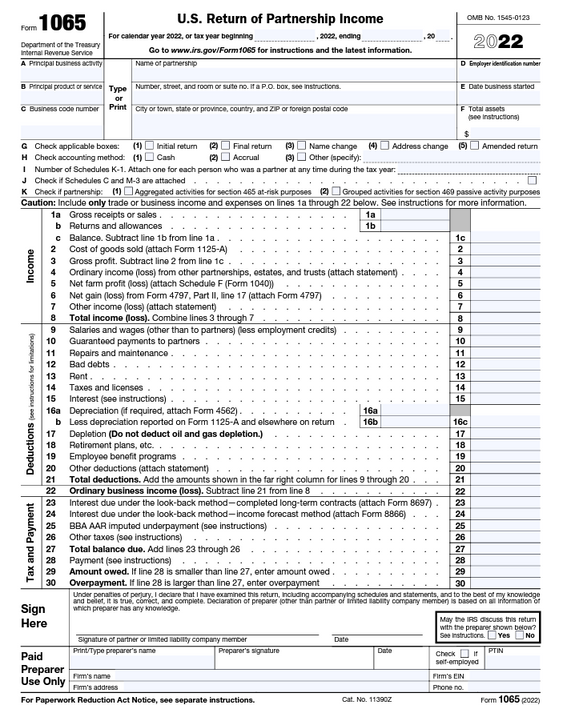

While partnerships don't pay federal or state income tax or state franchise tax, an information 1065 return form is required by the IRS by March 15. The form consists of 3 parts: Profit and Loss and statement that shows the sales, expenses and net income of the partnership; Balance Sheet reflecting the assets, liabilities and equity of it and K-1 forms where the income is distributed among the partners. Unlike schedule c, 1065 is filed separately from the partners’ individual tax returns.

For example: Joe and Kelsi have a general partnership. In 2022 they had $200,000 in sales, $120,000 in expenses and $80,000 in net income. Kelsi owns 60% and Joe owns 40% of the partnership. 2 forms K-1 are issued showing $32,000 distributed to Joe and $48,000 to Kelsi. Joe and Kelsi later report this on their personal tax returns where the income will most likely be subject to personal income tax and self-employment tax.

There is no special procedure for the partners to pay themselves or to invest money in the business. Owners can make non tax deductible withdrawals and nontaxable deposits as long as they keep tab on partners distributions and contributions.

General partnership | |

Registration | Internal partnership agreement and EIN must be obtained. No registration with the state is required. |

Name | Tied to partners' name, not unique |

Liability | Unlimited |

Business Tax | None. 1065 information return must be filed by March 15 |

Taxes | Self-Employment tax, Personal income tax |

C Corporation

While there are non-profit and non-stock corporation too we will review stock corporations. A stock corporation is a legal entity separate from its owners who own shares. In a stock corporation, the ownership is divided into shares, and each shareholder's ownership is proportional to the number of shares they hold. The shares represent the ownership interest in the company and entitle the shareholders to certain rights, such as voting rights, dividend payments, and the right to share in the company's profits and assets.

Corporations must be registered with the state. If planning to operate in 2 or more states you will most likely need to register in each state separately. After the registration EIN must be obtained. The name has to be unique within the state.

Here are the steps for starting a corporation.

- Formally register with the secretary of the state by filing Articles of Incorporation: in our states section we'll cover in detail specific requirements and fees each state has for registering a corporation

- Obtain an Employer Idnetification Number number: this step will be covered in detail in our EIN section

- Write the Bylaws: outlining the internal rules and regulations of the corporation as wells as appointing directors and officers

- Issue stock: after authorizing the number of stock that can be issued in the articles or incorporation, the corporation can sell ownership to potential shareholders

Registration

Articles of Incorporation

Articles of Incorporation, also known as a Certificate of Incorporation or Corporate Charter, are legal documents that outline the foundational details and structure of a corporation. These documents are filed with the secretary of state's office, to formally establish a corporation as a legal entity and are publicly available

The articles of incorporation typically include essential information such as:

- Name: The official name of the corporation, which must be unique and distinguishable from other registered entities.

- Registered Agent: The individual or entity responsible for receiving legal documents on behalf of the corporation.

- Principal Place of Business: The primary physical location where the corporation conducts its operations.

- Purpose of the Corporation: A statement describing the nature of the corporation's business activities or objectives.

- Authorized Shares of Stock: The number and type of shares of stock that the corporation is authorized to issue. This outlines the ownership structure of the corporation.

- Board of Directors: Information about the initial board of directors, including their names and addresses.

- Duration: Specifies whether the corporation's existence is perpetual or has a predetermined termination date.

- Bylaws: Although not typically included in the articles of incorporation, a reference to the corporation's bylaws may be included, as they provide further details about the corporation's internal operations and governance.

- Incorporators: The names and addresses of the individuals responsible for filing the articles and establishing the corporation.

Articles of Incorporation vary by jurisdiction, and different states may have specific requirements for what information must be included. Filing the articles of incorporation marks the formal creation of the corporation as a distinct legal entity, separate from its founders and shareholders. It grants the corporation certain rights, privileges, and responsibilities under the law, including the ability to enter into contracts, own property, and conduct business activities. In our state's section we'll show references to on where to file them in each state.

Corporate Bylaws

Corporate bylaws are a set of internal rules, regulations, and procedures that outline how a corporation operates, governs itself, and makes decisions. Bylaws provide a framework for the organization's structure, management, and key operational aspects, ensuring consistency, clarity, and transparency in the corporation's activities. They are created and maintained by the corporation's board of directors and can be amended over time as needed. They are internal and do not need to be filed with a state or federal agencies.

Key components typically addressed in corporate bylaws include:

- Corporate Structure: Bylaws outline the hierarchy of corporate governance, including the roles and responsibilities of shareholders, directors, officers, and committees. This helps establish lines of authority and decision-making processes.

- Board of Directors: Bylaws define the size of the board, how directors are elected or appointed, their terms of office, and qualifications. They may also detail the board's powers and duties, as well as procedures for removing directors.

- Officers: The bylaws outline the roles and responsibilities of corporate officers, such as the CEO, CFO, and Secretary. They may also specify officer appointment procedures and the delegation of authority.

- Committees: Bylaws may establish various committees (e.g., audit, compensation, nominating) and define their composition, functions, and powers.

- Shares and Stockholders: They address matters related to shares, such as the issuance, transfer, and ownership of shares. Bylaws may also outline procedures for proxy voting and dividend distribution.

- Amendments: Procedures for amending the bylaws are typically included, specifying how changes can be proposed, approved, and recorded.

- Indemnification: Bylaws may include provisions for indemnifying directors and officers against legal actions or liabilities incurred in the course of their roles.

Shareholder's Agreement

Shareholders' agreement is a more specific agreement among certain shareholders that addresses their individual rights and relationships. This is an internal document and does not need to be filed with federal or state agencies.

- Scope and Purpose: A shareholders' agreement is a private contractual arrangement among specific shareholders of the corporation. It addresses the rights, obligations, and relationships between individual shareholders.

- Binding Nature: A shareholders' agreement is a private agreement between the parties who sign it, typically the shareholders who are parties to the agreement. It's not usually filed with regulatory agencies and doesn't govern the corporation as a whole.

- Customization: Shareholders' agreements are highly customizable and can address specific issues that are relevant to the parties involved. They allow shareholders to tailor their arrangements to their unique circumstances.

- Content: A shareholders' agreement often covers matters such as share transfer restrictions, buy-sell provisions, dispute resolution mechanisms, exit strategies, and other matters relevant to shareholder interactions.

- Amendment: Shareholders' agreements can only be amended with the consent of the parties who signed the agreement, in accordance with the terms set out in the agreement itself.

Issue Shares

Issuing stock involves creating and distributing ownership shares of a corporation to investors or individuals who become shareholders. Here's a general overview of the process:

- Determine Stock Type and Class: Decide on the types and classes of stock you want to issue. Common stock and preferred stock are the most common types. Preferred stockholders usually have certain privileges over common stockholders, such as priority in dividend payments.

- Authorize Shares: The number of shares to be issued needs to be authorized in the company's Articles of Incorporation. This is typically done during the initial incorporation process, but additional shares can be authorized later if needed.

- Set Par Value (if applicable): Some jurisdictions require a par value for each share of stock. Par value is a nominal amount assigned to each share, often used for accounting and legal purposes. However, many companies issue "no-par value" shares to avoid complexities.

- Board Approval: The board of directors must pass a resolution to approve the issuance of new shares. This resolution specifies the number of shares to be issued, the price (if applicable), and any other relevant terms.

- Determine Issue Price: If you're selling the shares at a price higher than the par value (common with common stock), determine the issue price per share. This could be based on the current market value of the company, negotiation with investors, or other factors.

- Offer Shares: Offer the newly issued shares to potential investors. This can be done through private negotiations or through public offerings like Initial Public Offerings (IPOs) if the company is going public.

- Subscription Agreement: Investors interested in purchasing shares will enter into a subscription agreement. This document outlines the terms and conditions of the share purchase, including the number of shares, price, payment terms, and any restrictions.

- Payment: Investors make payments for the shares they're purchasing as per the terms in the subscription agreement. Payment can be in the form of cash, assets, or services, depending on the arrangement.

- Issue Stock Certificates or Electronic Records: Once payment is received, the company issues stock certificates to the shareholders as evidence of their ownership. In modern times, electronic records are often used instead of physical certificates.

Issue Shares

- Recordkeeping and Regulatory Filings: Keep accurate records of all issued shares and their ownership. If required by regulations, file necessary paperwork with regulatory authorities to report the issuance of shares.

- Update Shareholder Records: Maintain a shareholder registry that includes the names, addresses, and ownership details of all shareholders. This information may be needed for voting, dividends, and communication.

Taxation

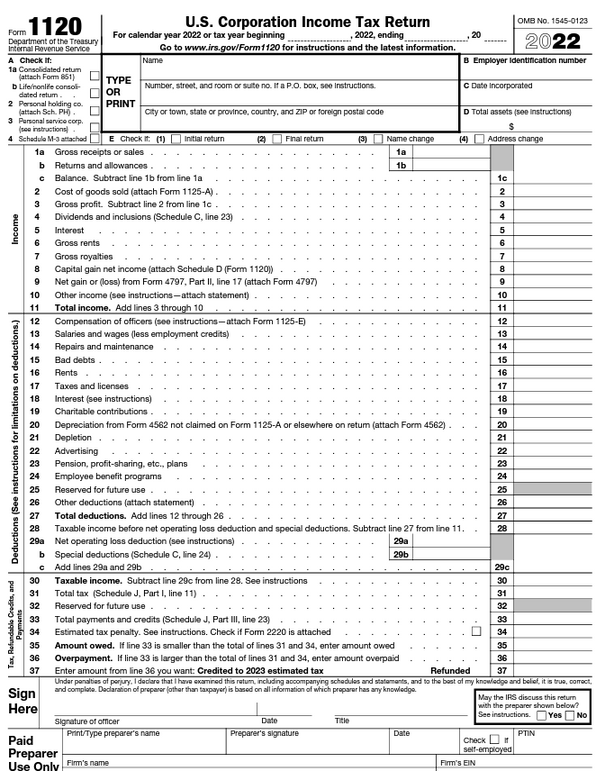

By default, every corporation is taxed by IRS as a C corporation. Unless S corp election was made or a tax exempt status was approved, the corporation must file federal form 1120 by April 15th of the following year. The form consists of 3 main parts:

- Profit and Loss

- Balance Sheet

- Compliance Survey

In the Profit and Loss section business expenses are deducted from the gross profit and the resulting net income is subject to 21% flat corporate tax rate. The tax can later be reduced by various tax credits such as Employee Retention Credit or Research and Development Credit. The net income left after paying tax is called retained earnings. Corporation may choose to distribute it to shareholders or reinvest it in operations.

Corporations must also file tax returns in most states they do business. Typically, a c corporation is only responsible for state tax on the portion of the income that derives from that state. In our states section we'll cover in detail tax rates and filing requirements for each state.

Paying Yourself

There are 3 ways corporation can pay it's owners

- Dividends

- Reasonable Salary

- Stock Buybacks

Dividends

Dividends are not limited to large institutional investors or stockholders alone. Business owners, particularly those who operate as shareholders in their own companies, can pay themselves in the form of dividends as a mean of compensation. The biggest disadvantage of paying oneself in dividends is the double taxation as dividends are paid in after tax money. For instance, c corp made $100,000 in net profit. $21,000 is paid in federal income tax and the remaining $79,000, distributed in form of dividends is now subject to personal income tax of up to 37% and if the state also has an income tax one can wind up with almost 60% effective tax rate.

Salary

C corporation owners not only may but are required to pay themselves a reasonable salary if they actively participate in the management and running of the company. Once put on payroll the business owner will be hit by Social Security and Medicare taxes, a myriad of other local taxes and payroll processing costs. On the brighter side, all those costs are tax deductible. If the income after all other deductions is $100,000 from which $60,000 is wages, corporation is responsible for approximately $4,500 in payroll taxes and the owner pays another $4,500 in Social Security and Medicare. The remaining net income of the corporation is now $100,000-60,000-4,500 = 35,500. 21% is $7,455. Net profit after tax is $28,045. Now that distributes as dividends and owner's personal income is $88,045 ($60,000 + $28,045), higher than if paid the full amount in dividends but the owner only paid so far $16,455 instead of $21,000 in taxes. In our “Hire Employees”section we will cover the process for hiring and paying employees and contractors.

Stock Buyback

This, not well known, but a very efficient way of compensating oneself, takes advantage of lower long-term capital gain tax rates compared to income tax rates. The C Corp can use its retained earnings to repurchase its shares Say, Kelsi personally owns $79 in her company's shares. She bought them more than a year ago. C Corp decided to buy them back at a higher price since the company is doing much better than when she just founded it. So, she ends up receiving $79,000. Since she bought the shares more than a year ago, the proceeds from the sale will be recognized as a long-term capital gain and be subject to a maximum 20% tax unlike income tax that can be as high as 37%

Adding Capital

There are 3 ways owners can inject capital in the corporation

- Owner's capital

- Additional Paid-in Capital

- Loan

Owner's capital is the money paid to corporation in return for shares. The biggest advantage is that withdrawals are not taxable. If the owner bought 100 shares for $1000 and alter withdraws $500 from that he or she will lose control over 50 shares but will not pay tax on it. The disadvantage is that it affects the stock price of the company and if there are no longer authorized shares available, the company will need to change articles of incorporation and authorize more which may have a significant affect on the price of the stock.

Additional Paid-in Capital is the amount exceeding the par value of the stock. If the stock has a part value of $1, the corporation may sell it for a higher price and the additional amount will be the APIC. However, withdrawals from APIC are likely to be taxable.

Loans from owner to corporation help corporations and owners avoid affecting stock basis or paying tax on withdrawals. A loan, however, must have a clear understading on when and how the money will be repaid. Charging interest is not mandatory.

C Corporation | |

Registration | Required in each state it operates. EIN is required. Name must be unique |

Ownership | Shares. No limit on shareholder number or shares issued |

Liability | Limited |

Business Tax | 21% federal net income tax. States may impose taxes to |

Tax Form | 1120 must be filed by April 15 |

S Corporation

Imagine being a corporation but not paying corporate taxes and imagine being self-employed and not paying self-employment taxes. That's what an S corporation is. S corporation, instead of paying 21% tax on their net income passes it on to its shareholders who generally report it as a passive income on their personal tax return. Since it's a passive income it's not subject to self-employment taxes unlike income from sole props and general partnerships. However, there are few limitation S corporations have:

- There can only be 100 shareholders

- All shareholders must be US residents

- Net income must be distributed to shareholders and is later taxed on a personal level

- Only 1 class of stock can be issued

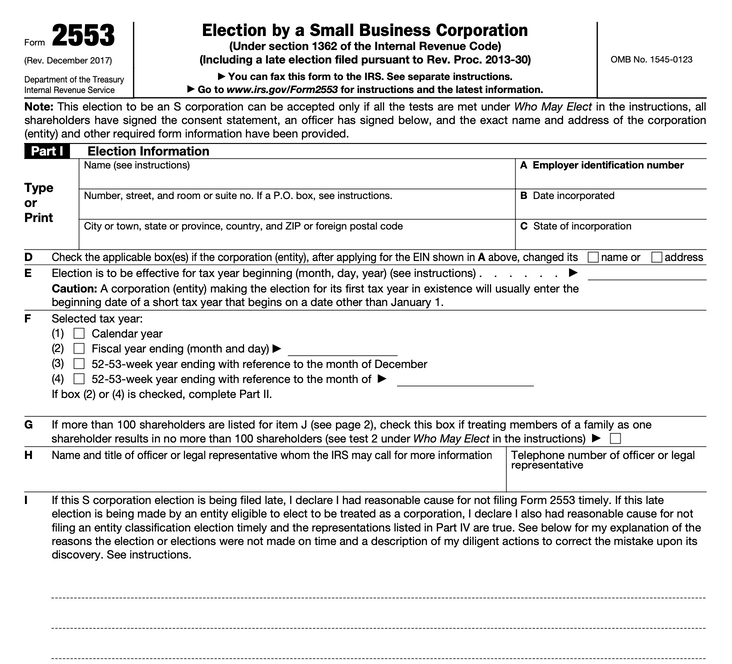

To register, follow the same steps as when registering a c corporation. once registered, IRS will by default classify it as a S corporation. To change it to S, form 2553 must be sent to IRS before 2 month and 15 days after the registration. Existing C corporations, willing to make and S corp election must send it no later than 2 months and 15 days after the start of the tax year, typically March 15th. For example, a new corporation was formed on June 10, 2023. August 21st, 2023, will be the last day to make S corp election. If the election is made later, the corporation will be an S corp for 2024 but will remain C corp for 2023. Similarly, if an existing corporation wants to be treated as an S corp beginning from 2024 the 2553 needs to be filed before March 15th 2024.

Registration

Form 2553

The form may seem confusing at a glance but, unless you are filing late or trying to change your calendar year you only need to fill out pages 1 and 2. Let’s assume a newly formed corporation on June 1. 2023 wants to make an s corp election.

- Part I enter the name, address, EIN, date and state of incorporation.

- D: leave blank unless name or address change

- E: June 1, 2023, in our case (or the date you want it effective)

- F: calendar year (selecting anything else may require additional filings and approvals)

- G: leave blank unless over 100 shareholders

- I: leave blank in our case, only fill out if filing late.

- Sign in the bottom of the

- On page 2 J: Enter information about each shareholder and have them sign.

- Mail or fax the form to addresses / numbers indicated here https://www.irs.gov/pub/irs-pdf/f2553.pdf

Taxation

S corporations, as mentioned, do not pay federal income tax, however, states may impose an income or revenue tax on them. In our state’s section we’ll cover every single state’s approach to S corporation. The 1120S information return must be filed typically by March 15. Failure to file can cost $220 for each shareholder for each month or part of the month the return is late. For example, an S corporation with 3 shareholders that filed their tax return on March 16th can face a penalty of $660 (1-month late x $220 x 3 shareholders). The same return filed on June 5th can cost the company $1,980 (3 months late x 220 x 3 shareholders).

Case:

Kelsi runs her Doe's Bakery LLC and made a net profit of $100,000. To make things easier she lives in a zero-income tax state.

Without 2553 election $100,000 would appear on her schedule c as a self-employment income and she'd be subject to $14,130 self-employment tax and $9,752 in Federal income tax making her total tax liability $23,822.

With 2553 election, she needs to pay herself a reasonable salary. Typically, 40% of net income is considered reasonable. Thus, she pays $40,000 in salary that is subject to 15% payroll taxes (between employer and employee responsibilities - more about it in our “hire employees”section) and $60,000 is distributed as a passive income. On her personal tax return 40,000 salary and 60,000 passive income are subject to $14,774 federal income tax. In addition, she pays $6,000 in payroll taxes making her total tax liability $20,774. $3,084 less than LLC or Sole proprietorship would pay on the same income.

Paying Yourself

There are 2 main ways S corporation owners can pay themselves:

- Payroll

- Distribution

While there are no laws on proportions, IRS requires a reasonable salary for S corp owners who actively oversee and participate in its operations. Single owner S corps often pay themselves around 40% of the net income as payroll and 60% as a distribution. The key difference is that payroll is subject to around 15% payroll taxes.

Limited Liability Company

First recognized in Wyoming, formed by members, Limited Liability Companies or LLCs are only recognized at a state level and disregarded by IRS. This means, that LLCs may be subject to state taxation but do not pay federal taxes or file any returns. Does this exempt an LLC member from federal taxes? No. Indeed, IRS automatically defaults single member LLCs to sole proprietorships and multi member LLCs to general partnerships and sets exactly the same tax filing and paying requirements. For instance, an LLC organized by 3 members in 2023, will have to file general partnership form 1065 by March 15 2024. The main purpose for forming an LLC is to limit the liability of members, just like the name suggests. The LLC cannot issue shares but instead has a membership that is proportional to the member’s contribution. There is generally no limit on the number of members. If one or more of the members manage the LLC it is called a member managed LLC. If a non-member manager is hired it is called a manager managed LLC.

Taxation

As mentioned, LLCs are taxed based on their classification. By default, single-member LLCs are classified as sole proprietorships and multi member LLCs as general partnerships. Therefore, they pay the same taxes and file the same forms on a federal level as sole props and general partnerships. On the state level, there may be additional forms and tax requirements that will be covered in our states section.

Registration

To Register an LLC follow these steps:

- File articles of organization with the state. Articles of organization outlines the key information about the LLC and is made public. The information includes but is not limited to: The name of the LLC; principal and mailing address; Registered agent; number of members; Most states will require updating articles of organization by filing annual or biennial reports even if no changes were made. In our states section we’ll cover the requirements for each state.

- Prepare an operating agreement: while not mandatory, an operating agreement outlines how the LLC will be managed; how the key decisions will be made; appoints managers; defines what will happen after passing of a member;

- Obtain an EIN number: Unless it is a single member LLC without employees an EIN is required.

- Collect membership contributions: members will make initial deposits.

- Start operations.

LLC as Corporation

The members of an LLC can make an election to be taxed as c or s corporation by filing respectively forms 8832 and 2553. Once the election is approved by IRS, the LLC will have exactly the same tax filing and paying responsibilities as a corporation. The main reason someone would want to have an LLC taxed as a corporation instead of directly opening a corporation is the vast liability protections the LLC offers. While corporation owners and officers are typically not personally responsible for the liabilities of the corporation, due to certain loopholes it may be possible to pierce through the corporate protections and go after the owners and officers on individual level. On the other hands LLCs provide much stronger protections.

Paying Yourself

Members cannot be employed or contracted by the LLC and instead should take distributions from the net income. 100% of the net income must be distributed. Just like in case of general partnerships, it is up to LLC to allocate the distribution between members. Each member will pay a personal income tax or corporate income tax if the member is a corporation based their part of distribution. There is no special procedure required for a distribution. A simple bank transfer or writing a check to a member will suffice. The same logic applies when making contributions to the LLC. However, if the LLC made an election to be taxed as a corporation, the corporate compensation rules will apply.

LLC | |

Registration | Required in each state it operates. EIN is required unless a single member LLC |

Ownership | formed by members. |

Liability | Limited |

Business Tax | No but a franchise tax is imposed by most states |

Tax Form | Depends on classification |

Tax/Type | Sole Prop / Partnership | LLC | S Corporation | C Corporation |

Taxation | Average | Average | Best | Worst |

Investor Preference | Worst | Good for investing | Good for investing | Best for investing |

Liability | Worst | Best | Good | Good |

Complexity | Easy to manage | Ok to manage | Hard to manage | Hardest to manage |

Case Study

A business has $100,000 net income. If it was a corporation, the owner would pay $40,000 salary to him or herself. Let’s look at how the tax obligations would change depending on the legal structure. Please note that certain assumptions are made. It is assumed that the business and its owner is in a zero-income tax state. In our states sections we will learn about state taxes but for now we will assume they are 0. It is also assumed that the taxpayer the is unmarried, has no children or other dependents and has no other source of income. In the table below We see that a sole prop or LLC report full $100,000 on owner’s personal tax return where it is subject to 14.3% self-employment tax and due to some deductions exclusive to self-employed people pay an effective 9.75% personal income tax. S corporation pays $40,000 salary to the owner subject to roughly $6,000 or 15% payroll tax. Then $60,000 of net income and $40,000 of salary are subject to an effective 14.77% income tax. Finally, c corporation pays $40,000 salary subject to $6,000 payroll tax, the remaining $60,000 is subject to 21% corporate income tax and the remaining $47,400, if distributed to the owner, alongside with $40,000 salary are subject to 13.7% personal income tax.

Tax/Type | Sole Prop / Partnership | LLC (not taxed as corp) | S Corporation | C Corporation |

Business Tax | 0 | 0 | 0 | $12,600 |

Self-Employment Tax | $14,130 | $14,130 | 0 | 0 |

Personal Income Tax | $9,752 | $9,752 | $14,774 | $12,002 |

Payroll Tax | $6,000 | $6,000 | ||

Total Tax | $23,882 | $23,882 | $21,827 | $30,602 |

Determine The jurisdiction

Choose State

Once the legal type of an entity is chosen, the next step in starting a company is to choose and register it within a jurisdiction. There is no such thing as a federal registration of an entity. Entities are registered in states and choosing the state is a key decision in starting a business. While the most commonsensical decision is to register an entity in the state it operates there are some intricacies business owners must be aware of. In this section we'll cover everything a business owner needs to know to choose the jurisdiction. We'll find out what is Nexus, what are the most common taxes levied by states and we'll show the tax rates and the registration process in every state. In the beginning let's meet the 3 agencies most businesses must deal in every state. The image below shows how the responsibilities are split between them.

Department of Revenue

Responsible for collecting taxes in a state such as revenue tax, income tax, franchise and sales tax

Secretary of the State

Responsible for registering

and keeping up to date

information about the business entity

Business

Employment Development Department

Responsible for collecting payroll taxes, accepting new hire and termination reports, processing unemployment claims and employee complaints

Nexus

Generally speaking, you must register your business in the state where you have a significant presence also known as nexus. For the purpose of registering with the secretary of the state and department of the revenue and paying franchise, state income and gross receipts taxes, the business has established nexus if one of the following is true:

- The entity has an office in the state

- The entity has employees in the state

- The entity has assets in the state

- The entity has a significant portion of its sales in the state. see the table in our sales tax section.

The first 3 are called a physical nexus, while the last 1 is called an economic nexus.

If the entity has established nexus in more than one state, it must register in any state it has done so. This can be done by registering as a foreign entity. For example, a California company that has opened a store in Texas will register as a foreign entity there. In this case the entity will apportion its income to each state and pay tax in a given state only for the portion of income derived in that state. For example, the aforementioned company has generated $1,000,000 in California and $200,000 from the new store in Texas. While for federal tax purposes, the entire $1,200,000 will be reported together, for state taxation $1,000,000 in CA will be subject to taxes in California and $200,000 in Texas.

Registered Agent and Business Address

When registering with a state, every business must provide 3 addresses:

- Principal: the main place where the business is conducted.

- Mailing: the place where the company receives regular mail.

- Legal, also known as a registered agent: the where the business accepts legal mail such as service of process.

While the first 2 do not have to be in the state of registration, the registered agent has to be in the state of registration. If the company is registered in multiple states, there has to be a registered agent in each state it is registered. When someone wants to file a legal complaint against a company, he or she can look up registered agent’s address in the secretary of the state records and serve the complaint there. The registered agent must be open to public during business hours and must accept the service of process. Failure to do so may default the company in the court. If the company has a representative in a state it is registered, such as an owner, employee or officer, that representative can serve as a registered agent. Otherwise, the entity can hire a commercial registered agent. It is basically a private company that agrees to accept legal mail for your business in a given state. The commercial agents are cheap, ranging typically from $25 - $200. A simple Google search will yield multiple agents, or you can contact the secretary of the state for the list.

It is also perfectly legal and common for a business to have the same address for its principal, mailing and registered agent as long as the latter is in the state of registration. For example, a hair salon in Fort Summers, New Mexico can list the place of the salon as its principal, mailing and registered agent address. Same is true for home-based businesses, however, the home address needs to be publicly available, therefore many business owners hire a commercial agent.

Secretary of State

Secretary of the state (SOS) is in charge of registering and keeping up to date information about business entities. For most businesses, filing with SOS is the first step in registering their entity. Information, such as the legal name of the company, its legal address and legal structure is made public by the SOS. Most SOS' charge a fee for formation of the business as well as require annual report fees to keep it in good standing. Other paid services include dissolving the business, providing proof of good standing, reinstating a dormant business etc... Basic information, including the name, type and legal address of the entity are typically available for public on the secretary of the state's website. Paradoxically, the registration with the SOS does mot create a nexus in the state. Many organization register with the SOS for purposes of opening a bank account, take advantage of a favorable court system or attract investors. SOS generally does not collect taxes but in some states may be in charge of collecting the franchise tax.

Franchise Tax

This tax is imposed by some states for the privilege of doing business. The word franchise does not refer to the business being a franchise of another corporation but rather refers to being a franchisee of the state itself, such as "a California corporation". Failure to pay franchise tax will result in dissolution of the business. Most states charge franchise tax based on the assets or revenue in the given state but some jurisdictions such as California, have a flat fee. Depending on the state it may either be levied by SOS or DOR.

Department of Revenue

DOR of each state, sometimes also called franchise tax board, is in charge of collecting most state taxes. After registering with the secretary of the state the business may also register with the department of revenue to pay franchise, sales, state income and revenue taxes. This is not always mandatory, since paid tax preparers and electronic tax preparation software can remit payments on behalf of the business. If the company doesn't owe any tax in the state the registration with DOR is not necessary. This is especially relevant when the entity is registered for the purpose of attracting investments, taking advantage of a more favorable court system or opening a bank account.

State Income Tax

This is by far the biggest tax burden imposed on businesses on a state level. it is a fraction of company's net income, i.e income after all tax deductible expenses. It's levied by the department of the revenue.

Revenue Tax

This tax is levied based on the gross profit of the company before any expenses. While significantly lower than income tax, it aims to assure companies don't manipulate business deductions and pay a minimum amount of tax. It is levied by DOR.

Sales tax

Sales tax is collected by DOR as well as counties and municipalities as a percentage of the sales price. It is collected by the seller from the buyer and remitted to the tax agencies such as the department of the revenue. In our sales tax section, we’ll go over sales tax more in detail.

Now let's review how the mentioned taxes and fees work in each state starting from California.

California

Tax/Type | LLC (not taxed as corp) | S Corporation | C Corporation |

Filing Fee | $70 | $100 | $100 |

Franchise Tax | $800 (due April 15 - first year payment due on day 15 of 4rd month) | $0 | $0 |

Statement of Information | $25 due 90 days after formation, then every 2 years | $25 due 90 days after formation, then every 2 years | $25 due 90 days after formation, then every 2 years |

State Income Tax | $0 | 1.5% (min $800) | 8.84% (min $800) |

Revenue tax | $900-$11790 | $0 | $0 |

Forms and due dates | 568 March 15 or April 15 | 100S March 15 | 100 April 15 |

To register an entity in California, first register with the secretary of the state at https://bizfileonline.sos.ca.gov The process will take few days.The biennial SOI can be filed there too. California LLCs pay a tax based on their revenue amount called LLC fee. Even if the LLC makes an election to be taxed as a corporation it is still required to pay the LLC fee. The fee is 0 if the revenue is below $250,000, $900 if from $250,000 - $499,999; $2,500 if $500,000 - $999,999 ; $6,000 if $1mm - $5mm and $11,790 if over $5mm

Wyoming

Tax/Type | LLC (not taxed as corp) | S Corporation | C Corporation |

Filing Fee | $102 | $102 | $102 |

Franchise Tax | 0.02% of Assets min $60 due | 0.02% of Assets min $60 | 0.02% of Assets min $60 |

State Income Tax | $0 | $0 | $0 |

Forms and due dates | Annual Report due on or up to 90 days before formation anniversary. no state tax | Annual Report due on or up to 90 days before formation anniversary. no state tax | Annual Report due on or up to 90 days before formation anniversary. no state tax |

In 1977, Wyoming, a state with roughly 500,000 people, revolutionized the business by becoming the first state to allow limited liability companies. Nowadays Wyoming is proudly considered the most business friendly state in the union. To register an entity in Wyoming, file company articles with the secreatry of the state: https://wyobiz.wyo.gov/Business/RegistrationInstr.aspx . There is no processing time and the registration is effective immediately after filing. Wyoming has no income or revenue tax. The annual report can be filed using the same link

Delaware

Tax/Type | LLC (not taxed as corp) | S Corporation | C Corporation |

Filing Fee | $110 | $109 | $109 |

Franchise Tax | $300 | variable. see next page | variable. see next page |

State Income Tax | $0 | None | 8,7% on income derived from DE sources only |

Revenue tax | $0 | $0.0945-1.9914 from receipts from Delaware sources only | $0.0945-1.9914 from receipts from Delaware sources only |

Forms and due dates | Annual Report with Franchise Tax due on March 1 | Annual Report with Franchise Tax Due on March 1 | Annual Report with Franchise Tax Due on March 1 |

To register an entity in Delaware file certificate of formation or incorporation with the SOS. You must download the form and fill it out from https://corp.delaware.gov/formsentitytype09/ . Once filled out, upload the form using the document upload system (down on weekends) at https://icis.corp.delaware.gov/ecorp2/ . The state will mail back with the acceptance stamp or contact with the reason for rejection. By march 1st the Annual Report with the franchsie tax payment is due. It can be filed at: https://corp.delaware.gov/paytaxes/ .

Delaware. Authorized shares vs Assumed par value capital.

Delaware allows 2 methods to figure out your franchise tax - authorized shares and assumed par value capital. Authorized shares is simply based on the number of issued shares. $175 for the first 5,000 ; $250 if between 5,000 and 10,000 and $85 for every 10,000 additional shares. So if the company has 10mm shares, ((10,000,000 - 10,000) / 10,000 ) *85 +250 = $85,165. But is there a way to keep 10mm shares and yet not pay that much franchise tax? Fortunately, yes. Assumed par value takes the total assets at the end of the year, divides by number of issued shares (assuming all shares have the same value) multiplies by number of issued shares that have a low par value than the ratio of assets and issued shares and divides that by 10mm and multiplies by 4. So, with $100 assets and 10,000,000 shares your franchise tax will be ((100/10,000,000)*10,000,000)/10,000,000 * 4 = 0.00004. Since there is a minimum of $400, the actual tax will be $400 + $50 filing fee.

Being a popular hub for high-tech investors and startups, it is important to mention that when an entity is formed for the sole purpose of attracting investments and take advantage of the court system in the state, the entity does not typically owe any state income or revenue tax as long as it has no activity in Delaware. And as long as it files the annual report and pays the franchise tax the entity is in a good standing with the state.

Texas

Tax/Type | LLC (not taxed as corp) | S Corporation | C Corporation |

Filing Fee | $300 | $300 | $300 |

Franchise Tax | 0-0.75% of revenue. see below | 0-0.75% of revenue. see below | 0-0.75% of revenue. see below |

State Income Tax | $0 | $0 | $0 |

Forms and due dates | no tax due, ez computation or long form is due by May 15 | no tax due, ez computation or long form is due by May 15 | no tax due, ez computation or long form is due by May 15 |

Instead of income tax, Texas imposes a revenue tax on entities generating revenue over $1,230,000 in Texas. The exceeding amount is subject to 0.375% tax for retail or wholesale businesses and 0.75% for all other. To register an entity in Texas, file the articles at: https://direct.sos.state.tx.us/acct/acct-login.asp. You will receive a mail with a web id that will help you sign up for a DOR account. You can file further reports using the online account.

Washington

Tax/Type | LLC (not taxed as corp) | S Corporation | C Corporation |

Filing Fee | $200 ($180 if paper) | $200 ($180 if paper) | $200 ($180 if paper) |

Franchise Tax | $60 | $60 | $60 |

Revenue Tax (Business and Occupation) | 0.471%-1.5% | 0.471%-1.5% | 0.471%-1.5% |

State Income Tax | $0 | $0 | $0 |

Forms and due dates | Annual report due on April 15, Monthly reports by 25th and quarterly by eom following quarter | Annual report due on April 15, Monthly reports by 25th and quarterly by eom following quarter | Annual report due on April 15, Monthly reports by 25th and quarterly by eom following quarter |

Washington offers its business owners no corporate income tax and low franchise tax. On the other hand entities must go through a relatively complex process of registration and pay up to 1.5 of Business and Occupation tax of the revenue.

Washington

To register a business in Washington, a 2 step process must be followed. First the entity must be registered with the secretary of the state https://ccfs.sos.wa.gov.The fee is $200. Next a letter with UBI and Account numbers will be mailed to the business. With the letterhead id and account number the business can be registered with the department of the revenue (DOR) https://secure.dor.wa.gov/home/Login by paying the $60 fee. This will allow the entity to pay its state taxes. While there is no business income tax, most businesses must pay a Business and Occupation tax as a percentage of the sales in the state. The percentage and frequency varies based on business type. The DOR website will determine it. While retail, wholesale and manufacturing have corresponding rates of 0.471%, 0.484%, 0.484%, services pay 1.5%. An electronic return is filed on DOR's portal at the end of which a payment is collected. If the entity is required to file taxes monthly, the return is due on 25th of each month, quarterly filers have to file by the 31st of the month following the end of quarter (January 31st, April 30th, July 31st, October 31st) and annual filers by April 15 of the following year.

Utah

Tax/Type | LLC (not taxed as corp) | S Corporation | C Corporation |

Filing Fee | $54 | $54 | $54 |

Franchise Tax | $18 | $18 | $18 |

Revenue Tax (Business and Occupation) | None | None | None |

State Income Tax | 4.85% | 4.85% | 4.85% |

Forms and due dates | Annual Report & TC65 April 15 | Annual Report & TC20S April 15 | Annual Report & TC20 April 15 |

To register an entity in Utah first register with secretary of the state https://secure.utah.gov/osbr-user/ . The process will take few days. Once the registration is complete you will also need to register with the taxpayer access point https://tap.tax.utah.gov/TaxExpress/_/ to file and pay your taxes. Your annual tax return is due by April 15 of the following year with payments of a 4.85% income tax . In addition a renewal fee of $18 is due every year.

Wisconsin

Tax/Type | LLC (not taxed as corp) | S Corporation | C Corporation |

Filing Fee | $170 | 100 | 100 |

Franchise Tax | $25 | $25 | $25 |

Revenue Tax (Business and Occupation) | None | None | None |

State Income Tax | None | 7.9% | 7.9% |

Forms and due dates | Annual Report | Annual report & Form 4 April 15 | Annual Report & Form 4 April 15 |

To register an entity in Wisconsin first register with secretary of the state https://onestop.wi.gov. The process will take few days. The annual report must be filed through the same portal. Once the registration is complete the entity also needs to be registered with the department of the revenue https://tap.revenue.wi.gov/BTR/_/ to pay taxes. The annual tax return is due by April 15 of the following year.

Pennsylvania

Tax/Type | LLC (not taxed as corp) | S Corporation | C Corporation |

Filing Fee | $125 | $125 | $125 |

Annual Report | $70 (due September 30) | $70 (due December 31) | $70 (due December 31) |

Revenue Tax (Gross Receipts) | Allowed on local level | Allowed on local level | Allowed on local level |

State Income Tax | None (personal level at 3.07%) | None (personal level at 3.07%) | 8.99% |

Forms and due dates | Annual Report | March 15 | April 15 |

To register an entity in Pennsylvania first register with secretary of the state https://file.dos.pa.gov/forms/business. The process will take few days. The annual report must be filed through the same portal. Tax payments can be made either through an e-file provider or through DOR portal https://mypath.pa.gov/_/. Pennsylvania has one of the highest corporate income tax rates.

Massachusetts